Digital services for insurance savers

In the digital service, you take care of your insurance assets quickly and easily without unnecessary waitsStay updated with digital services

Do you have an OP Unit-linked Insurance or Pension Insurance? The digital service will make it easier to use the services and to make necessary changes. After logging in, you can:

- keep track of the value performance of your insurance assets

- change the beneficiaries

- make additional investments

- change the investment or payment scheme

- change the asset allocation

By regularly keeping track of your investments’ development, you stay on top of things. In our digital service, you can diversify or switch investments based on geographical location, for example. You can also easily make additional investments or change your payment plan or beneficiary. Making changes in the digital service is free of charge. Make your daily life easier with our digital service. You can use the digital services with a mobile app or browser.

Change the beneficiaries

You can access videos and other social media content by allowing third-party marketing cookies.

Change your cookie settingsMake additional investments

You can access videos and other social media content by allowing third-party marketing cookies.

Change your cookie settingsChange the investment scheme

You can access videos and other social media content by allowing third-party marketing cookies.

Change your cookie settingsChange the payment scheme

You can access videos and other social media content by allowing third-party marketing cookies.

Change your cookie settingsChange the asset allocation

You can access videos and other social media content by allowing third-party marketing cookies.

Change your cookie settingsIf you would rather use OP-mobile, do this:

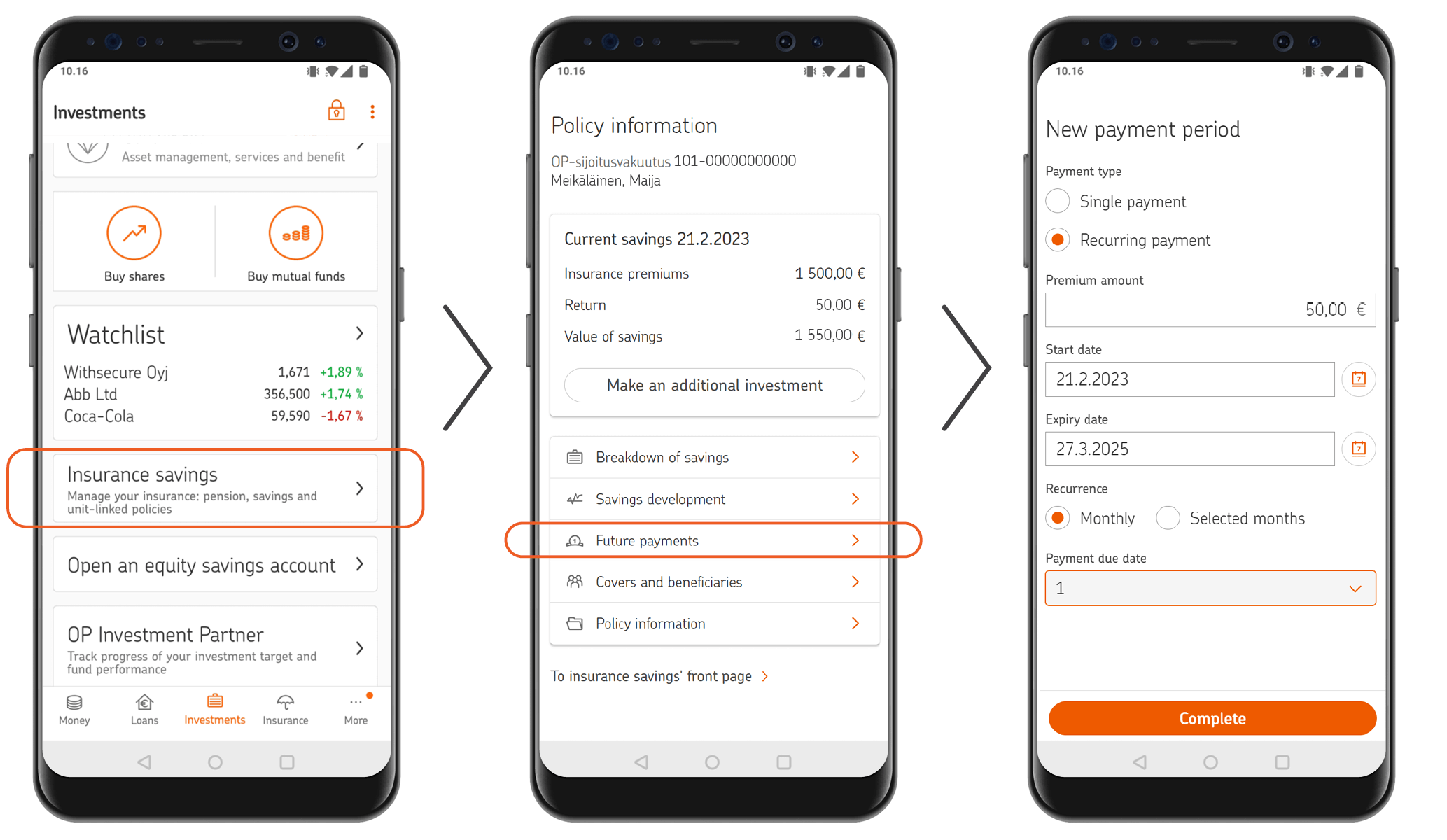

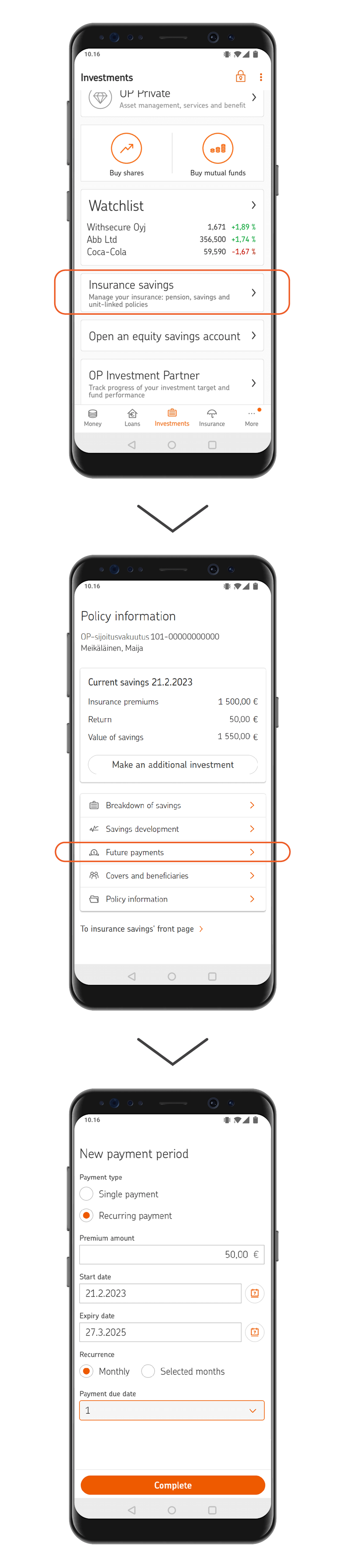

- Open the mobile app and log in (if you do not yet have the OP-mobile app installed, you can read further instructions here)

- After you have logged in, go to the Investments tab and select Saving Through Insurance.

- Select the right agreement.

- Check the details of your insurance policy and make changes, if you wish (the image below shows an example on how to make changes to your payment scheme).

Are you nearing retirement age?

When you have Pension Insurance and are nearing retirement age, you can, for example, lower the share of equity investments and transfer your pension savings to a fixed income fund with a lower risk. If your pension insurance includes unit-linked savings, the values of the investment instruments may rise or fall while you are withdrawing your pension. Therefore, the amount of your pension or the payment period may vary.

The initial start date of the pension and pension goal were determined when preparing the insurance contract. Have these changed or stayed the same? Are your beneficiaries also up-to-date or would you like to change who receives the life insurance payout in the event of your death? Remember that the beneficiary clause of the insurance is the person who receives the pension savings in the event of death. This always supersedes the will. You can also see this information in our digital service.

Pension drawdown begins after you have sent a report of starting the drawdown of pension (you cannot fill in the form with another bank’s credentials).

Withdraw savings from your insurance

If you have a savings or unit-linked insurance policy, and you wish to withdraw your savings, you can make the withdrawal by sending us a message through our digital services or call our Customer Service (you cannot fill in the form with another bank’s credentials).

Where can I get help for using the digital service?

Please call our Customer Service, ask about the matter in the chat service, or call your own OP cooperative bank.