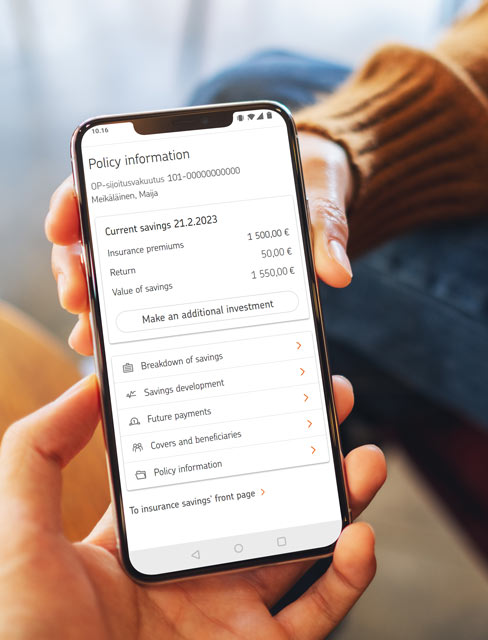

OP Unit-linked Insurance (OP Sijoitusvakuutus)

Endowment insurance suitable for long-term savingUnit-linked insurance is a flexible method for long-term saving

Do you wish to save for yourself, your children or a charity that is important to you?

Unit-linked insurance provides freedom of choice in your life, and it can be valid until you turn 100 years of age. However, you can change the saved sum or withdraw your savings at any time. You can start investing with, say, 100 euros per month.

Change investment options at any time and take advantage of the tax benefit

Add investment options to your unit-linked insurance based on your targets. You can change the options for free in our digital services.

One of the perks of unit-linked insurance is that you only pay taxes on the return when you withdraw savings. This means your investments benefit from the compound interest effect, and you have the best chance of good returns.

Unit-linked insurance also includes life insurance

With unit-linked insurance, you can transfer your assets to beneficiaries of your choice without a will. In the event of your death, the amount you have saved will be paid quickly to the beneficiary of your choice before the estate inventory.

You can change the beneficiary in the digital services free of charge at any time.

What is unit-linked insurance?

Despite its name, unit-linked insurance is not a traditional insurance policy but a form of saving and investing, where you can choose the investment options from our wide range of options. Unit-linked insurance is suitable for long-term saving. The benefit of unit-linked insurance is that any accumulated return is not taxed when switching investment options, but the funds are transferred in full to the new investment option.

Are you pondering whether to take out a unit-linked insurance policy?

Unit-linked insurance is suitable for you when you are looking for a flexible way of increasing your wealth, or when you wish to save for those important to you like your children. Unit-linked insurance is also a good option when you wish to retain the option of switching investment options included in the insurance when market conditions or your life situation change.

Try out the savings calculator

How to start investing in OP Unit-linked Insurance

-

Book an appointment

During the appointment, we will get to know you as a saver. We want to hear about your return targets and learn what type of risk-taker you are. -

Select investment products

Select your investing period, investment products and investment amount. You can get started with just 100 euros a month. Switching between investment products online is free of charge. -

Name your beneficiary

The beneficiary you select for the death benefit can be your spouse or child, for example. You can also easily change the beneficiary online.

What kind of investment options can I select for the insurance policy?

You can select one or more investment products for your unit-linked insurance from ready-made asset and wealth management solutions, sustainability-themed funds or, for example, funds that follow equity indices. You can select from:

- OP Premium investment baskets

- Responsible investment funds

- Saver's funds

- OP's wide selection of as many as 50 investment funds

Costs of OP Unit-linked Insurance

The costs consist of the service fees of the unit-linked insurance and the expenses of the investment products. In exchange, you get access to our wide range of products, which we are actively improving. We are continuously introducing interesting new investment products to our selection.

Withdrawing your savings becomes free after three years have passed.

1. Service fees

- Service fee of 0,4 % per year up to 94 800 €

- Service fee of 0,2 % per year for the amount exceeding 94 800 €

- Service fee of at least 1,90 € per month from the beginning of the fourth year

- No separate fees are charged on payments you make

2. Investment product expenses

The expenses of the investment products chosen for the unit-linked insurance vary and are reflected in the value of your savings daily. The annual expenses of investment products typically range from 0,15 % to 2,5 %, depending on the product.

3. Withdrawing savings

You can withdraw savings from your unit-linked insurance free of charge once your agreement has been valid for three years.

Customer stories

”I’m saving for posterity”

Seppo, 60

”I’m currently pondering whether to name my children or grandchildren as the beneficiaries of my unit-linked insurance. However, I can easily change the beneficiary myself in OP's digital services, for example. On the other hand, the insurance assets function as my reserve fund.”

“A bit like an equity savings account for funds”

Tiina, 45

”I can switch the funds included in my unit-linked insurance for free. This feature is important to me because I actively follow the market and adjust my investment strategy, depending on the situation.”

”I want to travel abroad”

Saija, 28

”I started investing in unit-linked insurance because my dream is to be able to travel. I invest a small sum each month and larger lump sums every now and then.”

Also learn more about OP Capital Redemption Contract

Do you want to save and invest flexibly without long-term commitments? OP Capital Redemption Contract is a unit-linked saving and investing solution valid for up to 30 years, or until the policyholder turns 100. Unlike unit-linked insurance, a capital redemption contract does not involve an insured person or named beneficiary, and it does not include a death benefit.

The contract offers flexibility for the management of savings. You can select your investment products from a wide range of funds and investment baskets, and switch them free of charge in our digital services. The proceeds from savings are only taxed when you withdraw funds from the contract, which enables tax-efficient saving. In the event of death, the capital redemption contract is transferred to the estate, and the distributees can continue investing, withdraw funds or terminate the policy.

About unit-linked insurance plans

Unit-linked insurance is an insurance wrapper through which you choose your investment products. You can monitor the market conditions and switch investment options if you wish. You do not pay tax on the investments’ return when you switch investment products within the insurance wrapper. You only pay taxes on the return when you withdraw savings from the insurance wrapper.

Unit-linked insurance does not need to be declared separately in tax returns. OP Life Assurance Company automatically provides the tax authorities with information about the profit share when you withdraw funds from the insurance.

You can name either yourself or your child, godchild or even an association you want to save for as the beneficiary of the unit-linked insurance.

Unit-linked insurance also includes life insurance, meaning that in the event of your death, the amount you have saved will already be paid to the beneficiary of your choice before the estate inventory and settlement of the estate.

If you wish, you can change the beneficiary of the insurance policy in our digital services at any time you wish, and for free.

Learning about the most common terms related to saving through insurance is a good way to familiarise yourself with this form of saving and investing.

- Endowment policy and endowment insurance usually refer to the same thing. Unit-linked endowment insurance is also often called an endowment policy.

- An investment basket is comparable to a mutual fund, but an investment basket can only be invested in through insurance savings products. The return of an investment basket is based on the value change of the investments in the basket. You can select the OP Premium investment baskets for OP Unit-linked Insurance.

- Saving through insurance is a form of saving and insurance just like investing in mutual funds and equities. When saving through insurance, the insurance forms a framework for different investment products. OP Unit-linked Insurance is a policy for saving through insurance in which insurance savers can use a single insurance agreement to diversify their savings into many different investment products.

- An insurance wrapper means that the insurance forms a framework or wrapper for different investment products. Insurance savers can thus diversify their savings into many different investment products using a single insurance contract. The term insurance wrapper is often used when discussing saving through insurance.

Read more about insurance wrappers

- Endowment insurance refers to an insurance savings contract which involves the appointment of a beneficiary for both the savings and the death benefit. If you die while the endowment insurance is valid, the beneficiary you have appointed will receive your savings. OP Unit-linked Insurance is an endowment insurance policy.

If you are an OP cooperative bank owner-customer, your savings will contribute towards OP bonuses.

- You will earn 0.35% of OP bonuses from funds linked to insurance assets. *

* The principles contributing towards OP bonuses from funds linked to insurance assets will be harmonised with direct investments. As of 1 January 2025, the following funds linked to insurance assets will no longer contribute towards OP bonuses: third-party funds such as JP Morgan funds, structured loans and institutional class funds such as OP-World III A.

OP bonuses are used to pay the bank’s service charges and insurance premiums.

Other owner-customer benefits from unit-linked insurance:

- Begin saving through insurance free of charge.

- Switch between investments, invest additional funds, and change your payment and investment plan for OP Unit-linked Insurance free of charge in our digital services.

The insurance policy is issued by OP Life Assurance Company Ltd. Cooperative banks act as agents for OP Life Assurance Company Ltd.