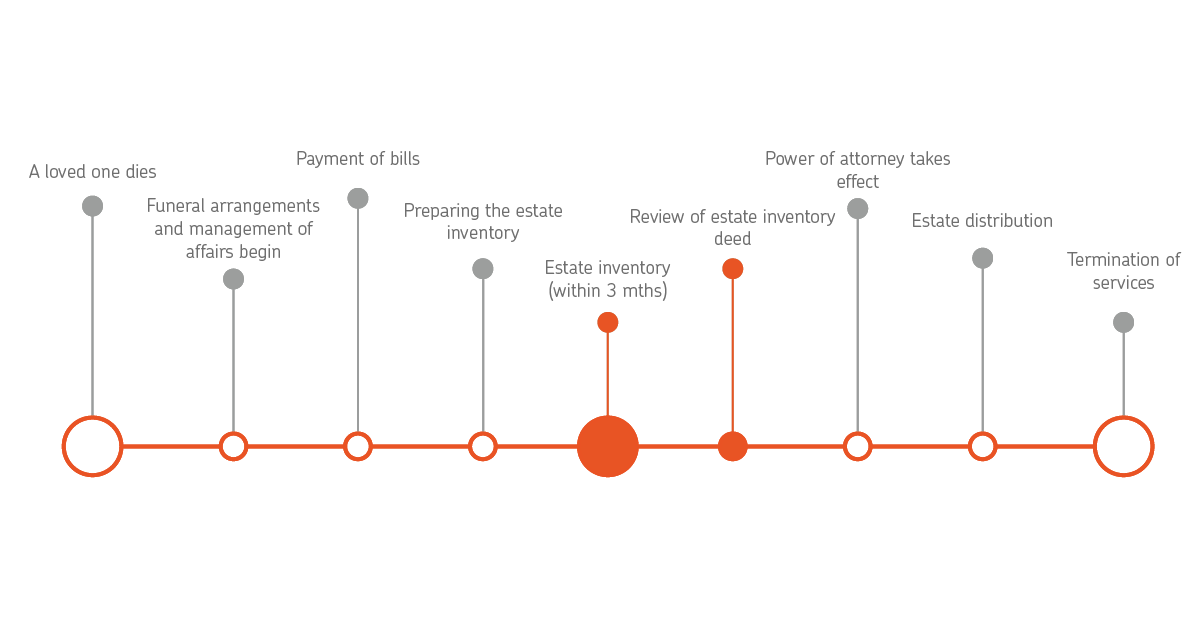

The estate inventory is an event at which an estate inventory deed is prepared. The estate inventory deed lists the property and distributees of a death estate. The surviving spouse’s assets and debts must also be specified in the estate inventory deed. It is also a tax declaration used as the basis for levying the inheritance tax.

The estate inventory deed must be completed within three months of the date of death. However, it is possible to apply for an extension to the time limit from the Finnish Tax Administration if needed. Submit the estate inventory deed to the Tax Administration within one month of its completion.

Reviewing the estate inventory

We also have a duty to know our death estate customers. To identify and verify the individuals authorised to manage the estate’s affairs, we need to have a signed estate inventory deed and all its appendixes. Make sure that you attach all necessary appendices. Submit the estate inventory deed with attachments to us easily or bring it to the nearest OP cooperative bank. After we have received the estate inventory deed and all its appendices, we will review them. This will usually take a few weeks.