What is a health declaration?

A health declaration is a questionnaire we use to record your health information in order to grant insurance.

If the insurance can be granted, it will enter into force on the date the health declaration was submitted. You may receive an automated insurance decision immediately after submitting the health declaration. If your health declaration needs to be reviewed by our experts, you will be notified when your insurance decision has been made.

It’s always worth completing the health declaration because you can often be granted insurance even if you have a diagnosed illness. Possible pre-existing illnesses or past medical examinations may affect the price and scope of the insurance coverage granted to you.

Only our experts specialising in health declarations can access the information you provide.

It is important that you do not terminate any existing policy until you have received a decision stating that a new policy has been granted.

Where do I find the health declaration for life insurance and critical illness insurance?

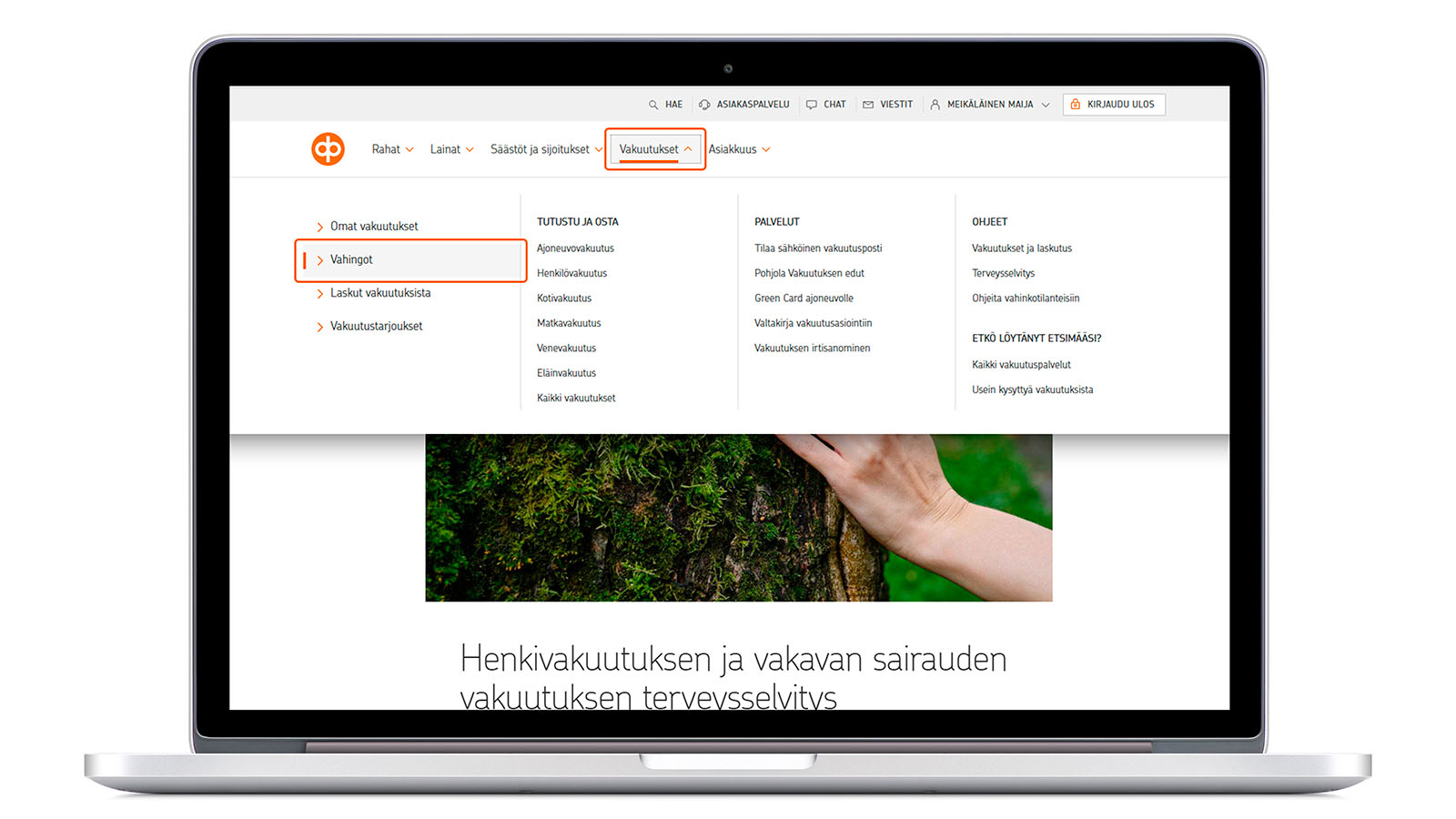

You can find your incomplete health declaration by logging into the op.fi service and then navigating to Vakuutukset – Omat vakuutukset. At the moment, the health declaration for life insurance and critical illness insurance can’t be completed on OP-mobile.