OP Virtual Account

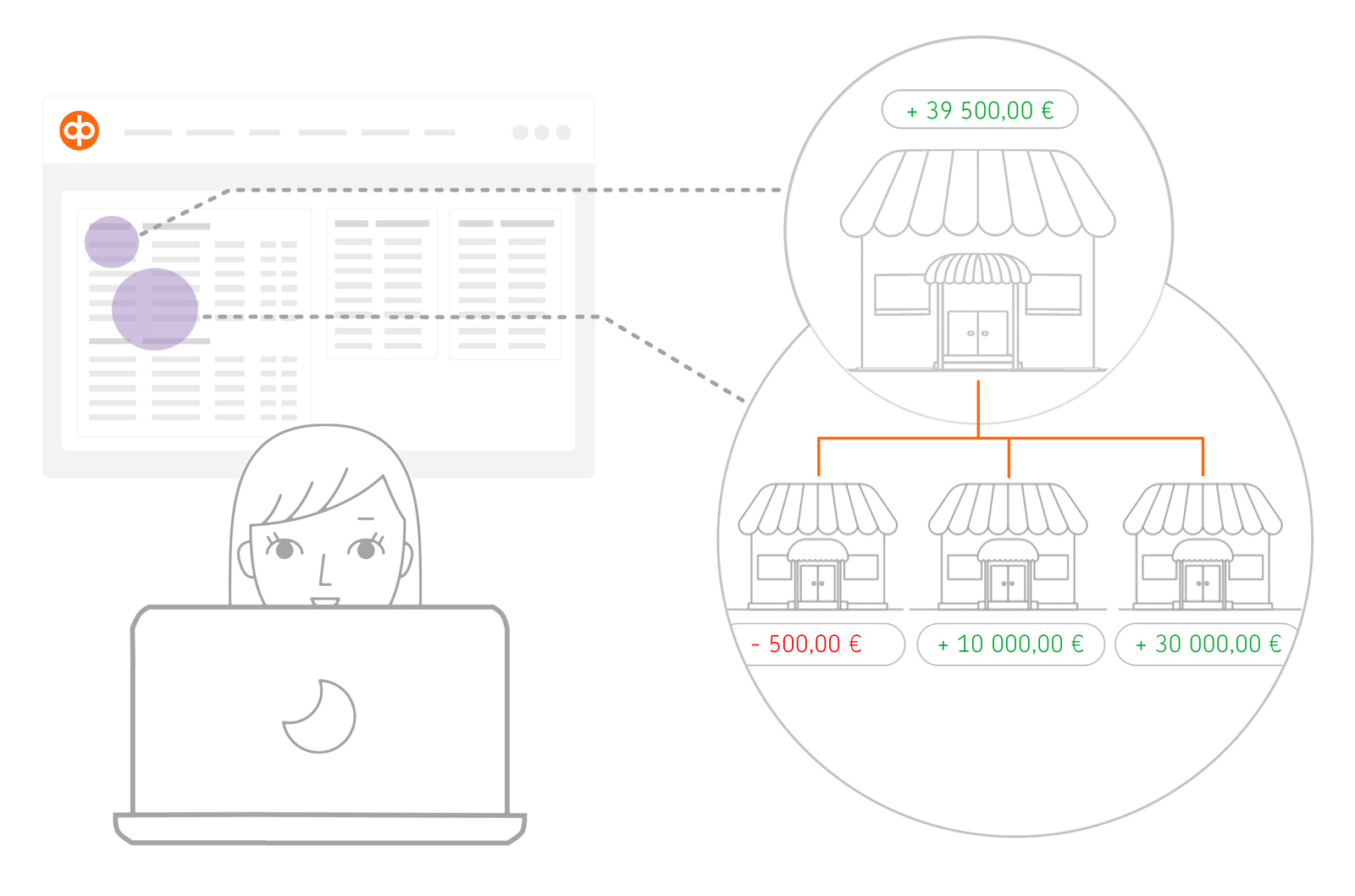

Track your company’s cash position and profitability more efficiently with an account structure customised to your business.Account structure for your company’s needs

You will automatically get a real-time and cash-basis view. You can allocate account transactions to income and cost factors exactly the way that is reasonable for your business, using criteria such as business locations, projects or products.

Easier analysis through ready-made classifications

Analyse your income and expenses in a versatile way and identify unallocated transactions easily by narrowing them down to a specific virtual account.

Flexible use of digital services

Manage your accounts yourself, including their number, structure, purpose of use and access rights, directly in OP’s digital service, without the need to contact your bank.

An account structure that meets the individual needs of your company

OP Virtual Account brings transparency to your company’s cash flows, makes your cost accounting more efficient and helps you prevent errors. You save time and effort by not having to open separate accounts for new units or projects. You can also direct payments made without a reference number straight to the correct account.

The virtual account structure is based on the corporate account, which is the only account subject to the obligation to keep accounting records. Under the main account, you can create virtual accounts that best support your business and daily routines.

The main account does not function as a payment transfer account. Instead, each virtual account is given its own IBAN for payments and invoicing. This enables you to monitor the transactions on each account as a whole.

Smooth account reporting

Using OP Virtual Account requires the use of Web Services, a banking connection channel for businesses. In the Web Services channel, you can search account transactions and pay bills just like you do on an ordinary account.

Main account transaction data includes details of transactions on individual virtual accounts. This enables you to use transaction data, from a specific virtual account, in the accounts ledger and automatic transaction processing. You can also generate the reports that you need on each virtual account in PDF and XLS format.

Want to hear more about virtual accounts?

Just ask us to get in touch.