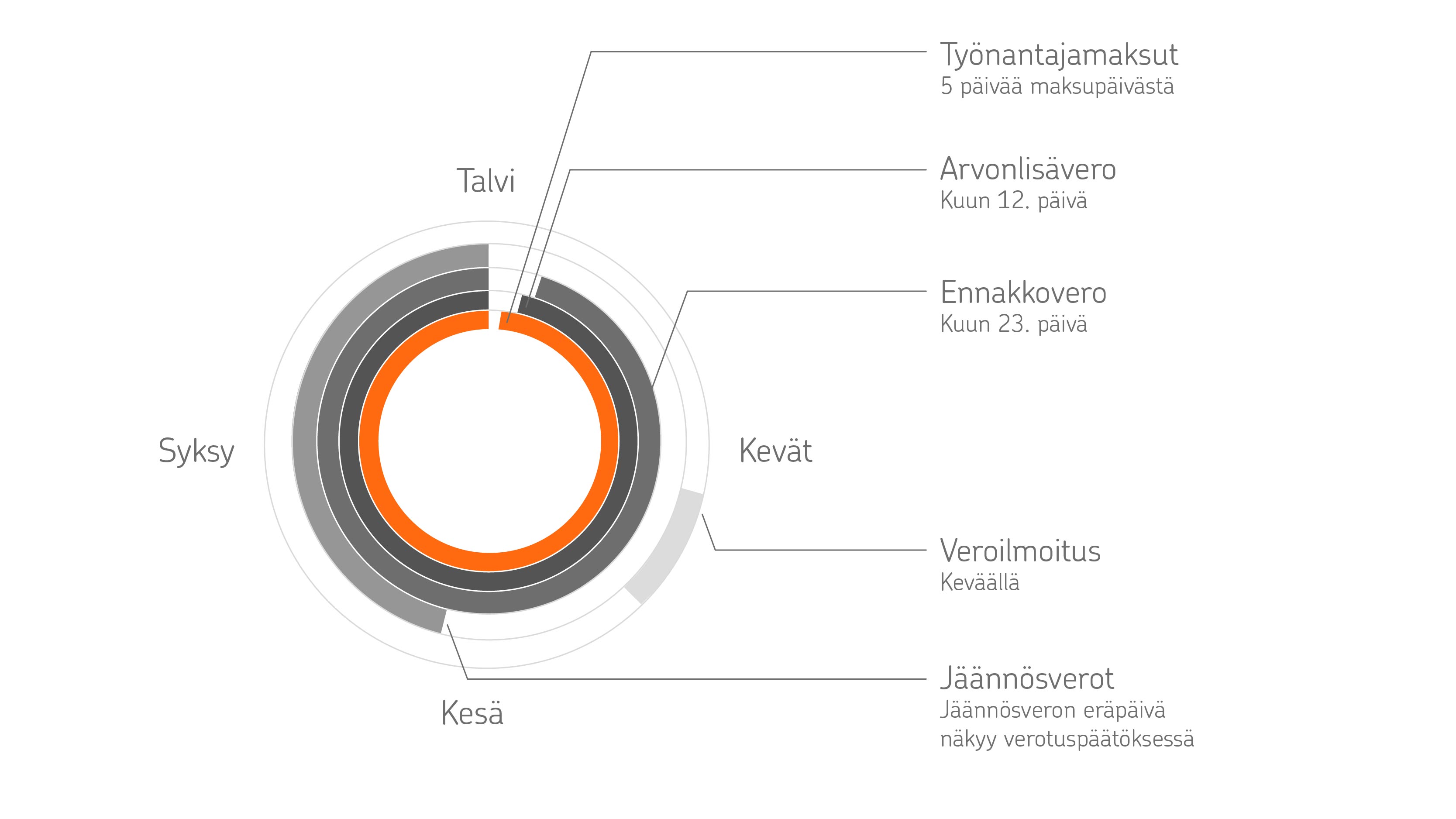

Value added tax (VAT)

WHO MUST PAY?: The entrepreneur under an obligation to pay value added tax (VAT).

AMOUNT: The amount of VAT is based on an entrepreneur’s sold quantities of products and services subject to VAT, and the amount of tax-deductible VAT payable on purchased products and services.

DUE DATE: The dates for tax returns and payments depend on the length of the company’s tax period: a month, a quarter or a year.

If it is a month, you must file tax returns and pay VAT once a month. The date for tax returns and payments is the 12th day of the second month following the tax period in question. Example: you must file your VAT return and pay VAT for March by 12 May.

VAT DECLARATION 2025: The easiest way to declare value added tax is in the taxpayer's self-tax service according to your VAT declaration date 2025.

If the tax period is per quarter or year, check the Finnish Tax Administration’s website for the tax return and payment deadlines

Prepayment taxes

WHO MUST PAY?: Any entrepreneur or limited liability company receiving income from a business activity.

AMOUNT: The amount of prepayment taxes is based on your latest finalised tax assessment. When a business is just starting, they are based on an advance estimate of income.

DUE DATE: A private trader can pay prepayment taxes each month, or two, three or six times a year. A limited liability company pays taxes each month or twice a year. If your company pays prepayment taxes each month, you must pay on the 23rd day of the month.

Employer’s contributions

WHO MUST PAY?: An entrepreneur that has employees.

AMOUNT: Employer’s contributions are mandatory costs in addition to salary. They are based on factors such as the employees’ age, salary and the duration of employment relationship. They include costs such as the employer’s health insurance end employment pension insurance contributions.

DUE DATE: You must submit this information within five days of the payment date. The payment date is that on which the payment is available to the payee: the so-called payday.

Back taxes

WHO MUST PAY?: An entrepreneur or limited liability company that has paid too little prepayment tax during the accounting period.

AMOUNT: The amount of back tax is based on how much tax remains unpaid.

DUE DATE: The due date is shown on the tax decision.

Tax returns

Tax returns are due in the spring, but the precise deadline depends on the form of company in question.

PRIVATE TRADER, THAT IS AN ENTREPRENEUR OF SELF-EMPLOYED PERSON: In 2025, business tax returns and individuals’ pre-completed tax returns have to be filed by 1 April 2025 at the latest. Individuals only file pre-completed tax returns if something needs to be corrected or added.

LIMITED LIABILITY COMPANY: Due date: 4 months from the end of the last month of the accounting period. In most cases, this is the end of April because the accounting period is the same as the calendar year.

GENERAL PARTNERSHIPS AND LIMITED PARTNERSHIPS: Business tax returns had to be filed by 1 April 2025.