The amount of scam calls has grown strongly. Scammers try to create a sense of panic and urgency by claiming that your money is at risk in some way. At the same time, they offer security and solutions by pretending to be employees of the bank.

What kind of a scam are we talking about?

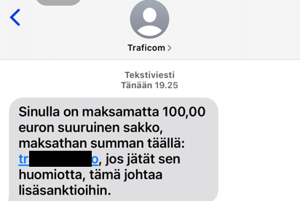

- You will first receive an SMS asking you to accept a payment from your account or pay an outstanding fine, for example.

- The SMS instructs you to click a link or call the given telephone number so that you can quickly solve the issue.

- In reality, the link will take you to a scam website that will ask you to provide your banking user identifiers. The telephone number also belongs to a scammer who will impersonate the bank's customer service representative or an employee of the "security department".

- The scammer may also call after sending the SMS even if you don't react to the SMS. It is particularly important to stay alert because the scammers will mention the SMS sent earlier during the call.

If you receive an SMS or phone call described above, do not do what they ask you to do

The bank never asks you for your username and password for the online bank or any security codes sent with a further confirmation message over the phone. If you receive such a call, remain calm and disconnect the call immediately. Then call your bank’s official Customer Service number and report the scam call.

Examples of SMS messages that have been followed by a scam call

Here’s how to make sure that you are truly speaking to a bank’s customer service representatives

-

Remember that your bank would never ask you to reveal your username and password over the phone.

-

Check the correct Customer Service number from your bank’s homepage.

-

If you use the OP-mobile application, you can request confirmation of call details during the phone call. Read the instructions on confirming call details

If you suspect that you have been a victim of fraud

If you need help with assessing a doubtful situation or suspect that you have been a victim of fraud, call our Customer Service on 0100 0500 (personal customers) or 0100 05151 (corporate customers). Our Customer Service is open on Mon–Fri, 8.00–16.00. Outside these times, call OP’s Deactivation Service on 0100 0555; this service is open 24/7. Be sure also to call Customer Service during service hours to report the incident.

This is how our messages differ from scam messages

The bank or authorities never make calls in which they ask customers to give their online user identifiers, make payments, or install an app on a device via a link sent by the caller.

We will never send you messages with a link to our online service’s login page. Nor will the bank ever ask you for your user identifiers or card details through messages. Such messages are scams – do not click on the links in the messages.

Even when receiving or cancelling a payment, you do not need to log in via a link, confirm with codes, or give your details. If you are asked to do this, call the bank's Customer Service phone number (after going to the bank’s website to verify the number for yourself).